P60 End of Year Certificate 2013 Explained

The figures on your P60 are the same as your year-to-date figures on your Period 12. As all employers are now required to file P14s online HMRC no longer issue P14 certificates for.

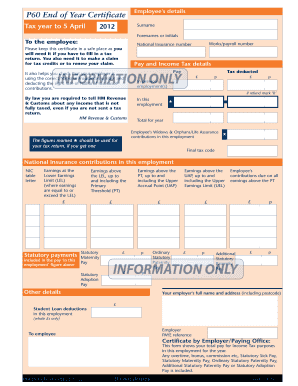

P60 Fill Online Printable Fillable Blank Pdffiller

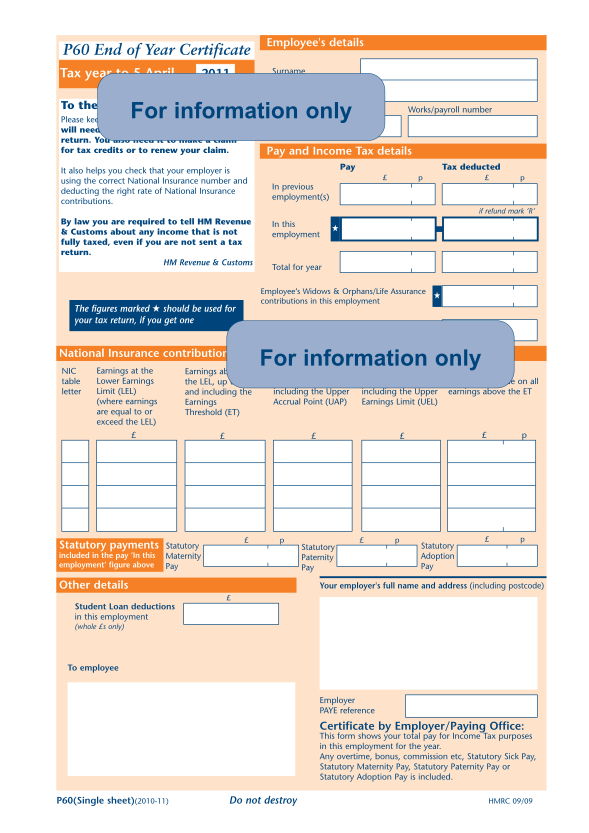

This 2013 P60 form is designed to mimic the style and layout for the 2013 P60 form used by HMRC.

. P60 2020 to 2021 has been added. Instead you can get an Employment Detail Summary through Revenues myAccount service. This P60 Form is designed to allow you to manually enter Employee Annual.

The figures marked should be used for your tax return if you get one. You get a separate P60 for each of your jobs every tax year. The form is flat so it does not calculate and may not render correctly depending on your browser due to certain anomalies on browser views but will print email correctly.

A P60 is a form used by HMRC. P60 2021 to 2022 has been added. It is essential that you keep your P60s as they form a vital part of the proof that tax has been paid.

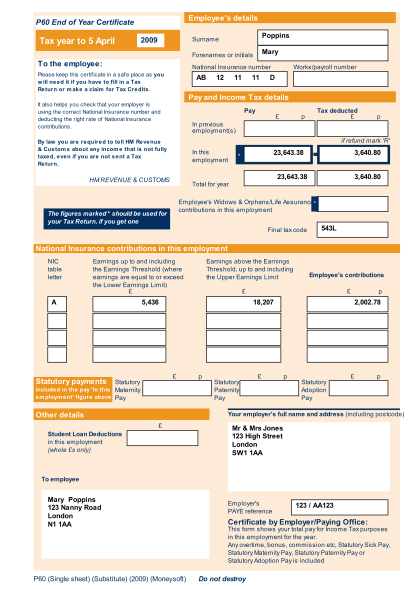

In the UK and Ireland a P60 is a statement issued typically via your employer to taxpayers at the end of a tax year. P60 end of year certificate - P60 continuous - Govuk. It is important a taxpayer does not destroy the P60 forms issued to them as they form a vital part of the proof that tax has been paid.

A P60 is issued at the end of each tax year. P60 End of year employee certificate The P60 is a certificate of an employees total earnings and total income tax deducted during the tax year including previous those of previous employers and also the amount of national insurance deducted by the current employer and should be issued to every employee the employer has at the 5th April each year. Due to HMRC discontinuing certain P60 form layouts from tax year 201112 QuickBooks now supports the HMRC P60 Single Sheet form.

The P60 form is also known as the End of Year Certificate. We cannot issue duplicate P60s so please retain this in a safe place. Tax year to 5 April 2022 P60 End of Year Certificate Employees details Workspayroll number if refund mark R p p To employee Pay Tax deducted Certificate by EmployerPaying Office This form shows your total pay for Income Tax purposes in this employment for the year.

The P60 is a summary of your pension and tax details for the Tax Year 20182019 which ends on 5 April 2019 and will make up the lower half of your May 2019 pension payslip. Dont get caught without P60 forms. For freelancers and contractors itll contain the salary youve received from your limited company or income earned from working via an.

Any overtime bonus commission etc Statutory Sick Pay. Please keep this certificate in a safe place as you will need it if you have to fill in a tax return. You also need it to make a claim for tax credits or to renew your claim.

You no longer get a P60 at the end of the year. A P60 End of Year certificate which summarises your taxable pay and the amount of tax and National Insurance NI you have paid for the tax year is issued every year usually in the last half of May. Please keep this certificate safe as other organisations often ask to see it as a proof of income if you make a claim for benefits.

A P60 is an End of Year Certificate that is issued to all employed taxpayers at the end of the tax year 5 th April for 2022 with the 2022 P60 due no later than 31 st May 2022. In the United Kingdom a P60 End of Year Certificate is a statement issued to taxpayers at the end of a tax year. PAYE draft forms.

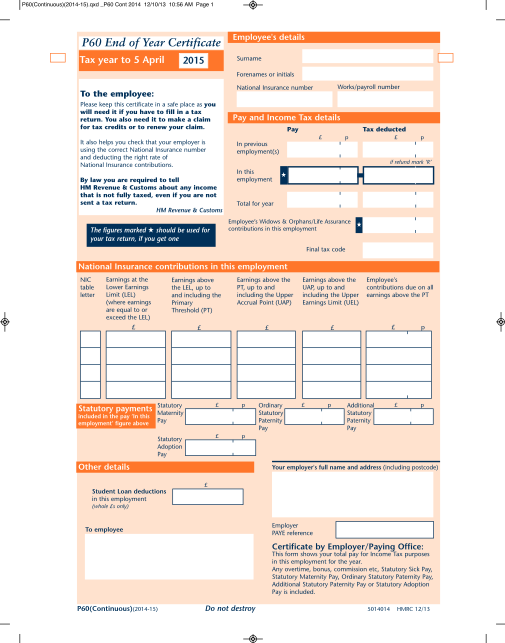

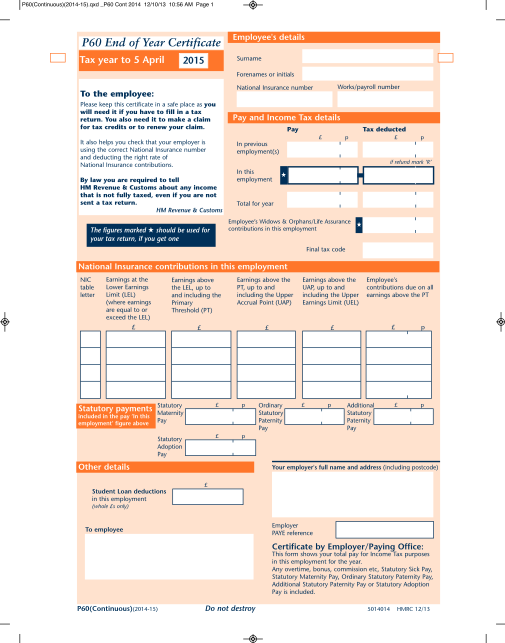

P60 2022 to 2023 has been added. Tax year to 5 April 2014 To the employee. A P60 is the form you get at the end of the tax year when youre employed PAYE.

If you use assistive technology such as a. This file may not be suitable for users of assistive technology. It shows all the money youve been paid and the deductions taken out of it.

If you are an employer you must provide a form P60 to each employee who is working for you at the end of the tax year and for whom you have completed P11. P60Cont 2013 14qxd _P60Cont 24042013 1124 Page 1. Tax year to 5 April 2018 P60 End of Year Certificate Employees details Workspayroll number if refund mark R p p To employee Pay Tax deducted Certificate by EmployerPaying Office.

P60 continuous 2020 to 2021 PDF 514 KB 1 page. This form shows your total pay for Income Tax purposes in this employment for the year. The P60 confirms an employees final tax code and shows their total pension andor earnings for the year as well as the years total tax deductions and National Insurance contributions.

The employer issues a Form P45 and a Form P60 to an employee when an employee may have been in employment on 31 December and left on that day. Theres a separate guide to getting. Your P60 will contain specific information about.

It also helps you check that your employer is using the correct National Insurance number and deducting. These can be ordered from the HMRC. If you ever find yourself having to prove how much tax youve paid your P60 is one of the easiest ways.

An Employment Detail Summary contains details of your pay as well as the income tax PRSI and Universal Social Charge USC that has been deducted by your employer and paid to Revenue. A P60 contains exact information about how much you have earned PAYE Paye As You Earn and NICs National Insurance Contributions you have paid during the specified tax year. P60 End of Year Certificate Employees details Tax year to 5 April 2021 Surname Forenames or initials.

Order Year End Forms. It is your responsability to check your P60 and claim back any overpaid tax or. Request an accessible format.

Its a useful piece of paperwork to have around so keep track of it. You also need it to make a claim for tax credits and Universal Credit or to. National Insurance number Workspayroll number Please keep this certificate in a safe place as you will need it if you have to fill in a tax return.

You also need it to make a claim for tax credits or to renew your claim. P60continuous2014-15qxd p60 cont 2014 121013 1056 am page 1 p60 end of year certificate tax year to 5 april employee s details surname 2015 forenames or initials workspayroll number national insurance number to the employee. P60 End of Year Certificate.

Please keep this certificate in a safe place as you will need it if you have to fill in a tax return. They were also issued in. Your P60 shows the tax youve paid on your salary in the tax year 6 April to 5 April.

It includes how much youve paid in National Insurance contributions and PAYE Pay as You Return income tax which means how much tax you have paid on your salary. HMRC style P60 Form 2013. More importantly they allow you to review how much Tax you have paid and decide if you have paid too much tax.

Also referred to as a P60 end of year certificate the P60 form is a document that shows all your employment income and deductions in a tax year - from 6th April to 5th April the following year.

20 P60 Form Free To Edit Download Print Cocodoc

21 P60 Form Download Page 2 Free To Edit Download Print Cocodoc

21 P60 Form Download Page 2 Free To Edit Download Print Cocodoc

No comments for "P60 End of Year Certificate 2013 Explained"

Post a Comment